If you listen to the propaganda spewed forth from the Mainstream Media you might be inclined to believe that this recession is like all the rest and the worst is behind us. I can assure you that nothing is further from the truth.

Take this chart for example.

That shows the Price To Earnings ratio for the S&P 500. For those that aren't familiar with investing P/E ratio can be found here. This chart shows that the historical average of the S&P companies P/E ratio is 16 meaning you will pay 16x annual earnings for a share of stock. So sit back and think about it, if a company say Apple makes 1 billion dollars a year you would be paying the equivalent of 16 billion dollars for ownership of Apple. Today however if Apple made 1 billion dollars it would cost you over 127 billion dollars to own the company. Of course what is driving up these absolutely ludicrous P/E ratios is the fact that the E (earnings) has dropped off of a cliff. The prices of the markets are so asininely, unsustainably high that it is laughable if it wasn't for the drones who buy into this green shoots BS.

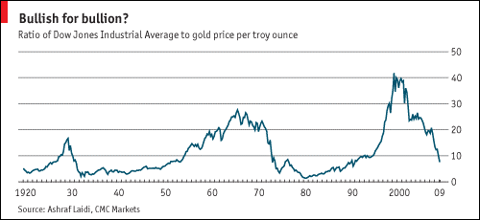

Let's look at this from another angle. Let's look at the performance of the Dow Jones Industrial Average priced in real money. The DJIA has gone from a low of 6500 in early 2009 to hovering around the 10000 dollar mark. That is just over 50% increase from March 06 2009 to November 06 2009. Impressive right? The media would sure like you to think so yet the reality is quite a bit more sobering. Take this chart for example.

The current Dow To Gold ratio is around 9:1 yet in 1999 when the Dow was again around 10,000 the ratio was nearly 45:1. Does this mean Gold has outperformed the DJIA? No because Gold is money, it is not an investment. Gold throughout history has had an incredibly predictable and stable purchasing power. This video does a good job of explaining the concept although it is a few years old and the markets have done many things since then.

The final point that needs to be understood by Americans is this, I have little doubt (and nor does anyone who has an understanding of economics) that the US stock market will go up when priced in US dollars which are nothing more than paper. Like Peter Schiff says, "priced in Zimbabwe dollars Zimbabwe's stock market is the best performing in the world." But who would want to live there? Sure their stock market is up 3500% year over year but inflation at last check was 231 MILLION percent. Now I highly doubt the US will experience anything this radical but the example is a sound one.

We are an empire at the end of it's rope. I will expand more on these economic ideas at a later date, for now I would encourage people to look at this post from February of this year. I have many more and updated charts that I will post in the coming weeks and months.