http://www.marketoracle.co.uk/Article6756.html

George Soros, one of the world's foremost investor-speculators, has said many times that he stays away from financial derivatives because “no one understands them”. In the world of finance, derivatives might be comparable to the theoretical study of linear particle acceleration in nuclear physics. Such theories appear to be “understood” mainly based on current assumptions accepted in academic circles, often with little provable working knowledge of how such currently-held theories might ultimately manifest themselves over the long run in the real world. The problem with assumptions is that they generally change…often sooner than we think.

Some might consider financial derivatives to be a form of “Russian Roulette” that's played for fun and extreme levels of short-run profit by a very small number of financial elites and academics. As you'll see, these high-stakes games are played at the potential risk of total destruction of all the functioning financial systems on Earth. Perhaps this is why Warren Buffett repeatedly calls them “financial weapons of mass destruction” or something similar.

I have a great deal of respect for the opinions of both Mr. Soros and Mr. Buffett and it is my intention to show you; 1. Why they feel as they do about derivatives and 2. the potential scale of the threat posed by derivatives and other similar forms of “financial innovation”.

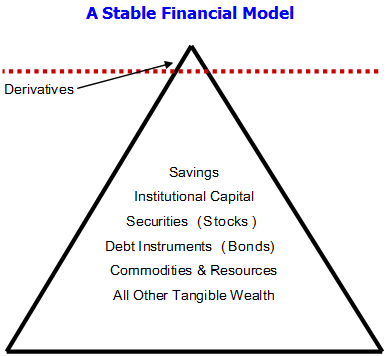

To help gain a “big picture” understanding of derivatives markets, one must start with a diagram. Here's one I created to help lay the groundwork to convey my understanding:

The “Stable Model” shown above shows that there is room for derivatives on the macroeconomic scene as long as they are kept on a very short leash and used for their intended purpose which is, solely, to help producers manage the risks of dramatic changes in markets they depend upon for raw materials used in production. A prominent example of this is the commodities futures markets.

Traditionally, commodities futures were used by companies like Kellogg's Cereal as a form of “insurance” to help them manage the risk of major price fluctuations in the grains they use to make breakfast cereal. By purchasing a futures contract to guarantee the future delivery price of the grains they needed to make cereal for the consumer marketplace, they could be certain that they could maintain relative price stability at the retail level (benefiting consumers) and still operate with the profit they would need to stay in business and serve the market.

In the early 1980's, derivatives began to appear that were of a strictly financial nature. The reasoning behind their regulatory approval was that producers of financial “products” and services also needed to have similar types of “insurance” to protect them against future risks and uncertainties - just like the non-financial operators had. The main selling point was, of course, that these financial futures contracts would help financial companies to stabilize their operations and provide powerful tools to manage their risks from fluctuating markets and future uncertainties, as well. Unfortunately, these sophisticated tools that were originally intended to help firms manage risk grew into potent vehicles for leveraged speculation… and this is where the systemic problems we're facing today originated.

During the 1990's, more and more firms (financial and non-financial alike) began realizing they could make tremendous profits trading in financial vehicles. Many firms made more money trading than they did in their core manufacturing businesses. Word spread and firms of all kinds across all industries began bringing in experienced traders and setting them up with computerized trading operations or they employed the services of outside money managers and hedge funds to do the job for them. Either way, with the seemingly endless expansion of financial opportunity brought about by the rapidly globalizing markets, companies feared they would look foolish to shareholders if they weren't participating in this leveraged gamesmanship. And why not? Everyone else seemed to be doing it, so they should too.

The first major threat to the global “casino” came in 1998 with the collapse of Long Term Capital Management (LTCM). LTCM was a highly-leveraged, computer-based trading firm whose ingenious program authors had not fully considered the possibility that a “statistically unlikely” series of events could occur in a short span of time and wipe them out. A series of such events (East Asian collapse, Russian financial crisis, etc.) did occur, bringing down LTCM and the failure of LTCM was, singlehandedly, large enough to destabilize the entire global financial system. At that time, governments banded together to stabilize the financial system and in doing so created the world's first example of a firm being “too big to fail”.

Once the “too big to fail” precedent had been firmly established, the structured finance and derivatives industry was off and running, emboldened by the fact that they'd proven governments could be relied upon for bailouts of massive, yet risky ventures pursued by financial firms in the future. The bigger the venture, the bigger the risk, the more likely it would be insulated from ultimate failure by government bailout or intervention with taxpayer money. This is what's commonly known as MORAL HAZARD in industry parlance.

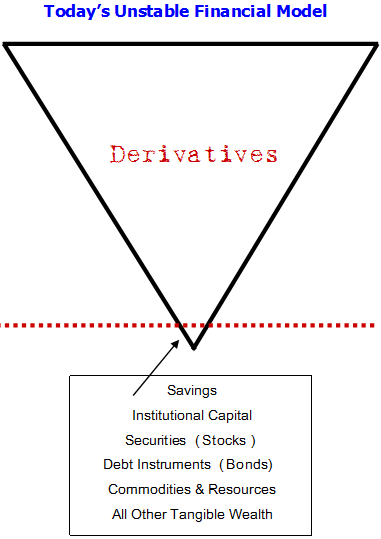

This new philosophy was a speculator's dream and it rocketed around the globe at the speed of light gathering eager new participants and “hot” capital wherever it went. According to my understanding, here's what it did to the global financial structure - mainly between 1996 and 2007 - leading us to the “edge of the abyss” that we are peering into today:

Now, I promised to help put the size of the problem we're facing into perspective for you and I'm going to switch gears and attempt to do that. To begin, let's consider the total productive capacity of the all the world's economies combined - the Gross World Product. To provide a credible figure, I'm going to use the one from the U.S. Central Intelligence Agency (CIA) which monitors this type of thing as an ordinary part of their operations. We'll assume they know what they're talking about and report genuine figures we can trust. The CIA says the estimated 2007 Gross World Product totaled $65.61 trillion dollars . The figure I'm citing is found on this CIA page:

ANNUAL GROSS WORLD PRODUCT (Official Exchange Rate)

In the business world, we would view the “total value of all goods and services produced and sold” as being the “gross sales” of a business. Gross sales generally has little bearing on “net profit” and perhaps even less relationship with the “total capital” of a business. Gross sales cannot be spent by the business. Only net profit can be spent or added to the capital base. Where businesses incur costs in producing goods for sale, countries consume or deplete resources and also incur costs.

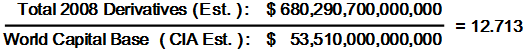

Another measure of the world's wealth is the CIA's reported total of “Direct Foreign Investment” - where nations (and their citizens) have invested abroad in other nations' shares and industries. These worldwide investments totaled $14 trillion at the end of 2006 .

Finally, we can look at the CIA's “Total Market Value of All Publicly Traded Shares” or TMV. TMV is the total value of all shares of stock issued and (presumably) outstanding that is available to trade on all of the world's stock exchanges. This total would probably be a pretty close approximation of the world's capital base which the CIA reported at $53.51 trillion as of the end of 2006 . With world markets having price collapsed during much of 2008, it's likely that recent TMV figures, if available, would be smaller than $53 trillion.

With what I've laid out so far, if I were a stock analyst reviewing the entire world economy as if it were a company, I would be able to tell you that the world's capital base was priced at about .816 times sales. I arrived at this by simply dividing TMV by Gross World Product as described above.

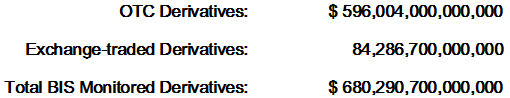

The next stop on our world financial tour takes us to the Bank For International Settlements (BIS). This is where the mind begins to be boggled. The BIS is the organization that tracks (or attempts to track) the total value of the financial derivatives that have been created and infused into the world financial markets. Bear in mind while reading that there are still other “private contracts” between parties (known as “off balance sheet” items) that do not show up in the BIS reported figures.

On the front page of the BIS website is a “STATISTICS” tab that links to their quarterly and annual reports on derivatives with the most current figures they've published. There are two separate formal markets - over-the-counter and exchange-traded - that the BIS tracks. As mentioned above, there are other private markets for derivatives that are not tracked by the BIS and those contracts are “off the radar” and won't show up in the BIS reports. (Readers should also note that the BIS derivative figures grew at a reported rate of 15% between 2006 and 2007, despite widespread economic turmoil so it's entirely possible that they're even larger now.)

Here are some recent BIS figures*…

(*Note: I used the 2007 year-end reported totals for the OTC numbers and the 2nd quarter 2008 reported totals for the exchange-traded derivatives, since both were the most recent data I could find on the BIS site. I've done my best to try to be accurate but, given the complexity of the BIS reporting, I'd welcome input from readers who can point out any inaccuracies in my interpretation or math. I'll make corrections as necessary. All values shown are the Notional (Face) Value of the contracts outstanding.)

Now that we have an idea of the reported “face values” of derivative contracts outstanding we can begin to relate it to the world's capital base and annual gross productivity via the CIA figures I've gathered and presented above. The first calculation below shows that the current world derivatives markets have leverage that is 12.713 times larger than the entire estimated world capital base. Put another way, a loss of only 7.87% of the total derivatives exposure would, apparently, be enough of a loss to wipe out ALL of the world's capital.

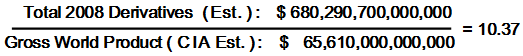

The next calculation shows that the current world derivatives exposure is approximately 10.37 times the CIA estimated Gross World Product for the year 2007, a year with a strong world economy.

That's the world exposure. But what about the “mother lode” of concentrated derivatives exposure right here in the USA? Take a quick run over to the following link and review the table provided there to see the figures for some major US banks back in the Spring quarter of 2008. While you're there, notice the column “OBS Derivatives”, which - as noted above - means “off balance sheet” holdings of derivatives by an institution:

As you can see on the table at the “Big Picture Blog” (many thanks to them for their post), U.S. bankers should have their very own “reality TV” show entitled BANKERS GONE WILD! for how they're rolling the dice with our money and our financial system. All the banks on this list (remember, things have deteriorated since Spring 2008) have exposure amounting to many, many times their total capital. As capital is eroded due to ongoing “realized” losses and further impairment of capital assets, the situation only gets worse. These banks must be propped up or merged together to avoid a meltdown, as we've already seen happening. Their exposure alone is apparently enough to consume all of the world's capital as calculated above. This is the epitome of “hubris” and a textbook case of MORAL HAZARD that conquered an entire industry. The problem this time may not be “too big to fail” but, more accurately, “too big to save”. Only time will tell. But, seriously, do you REALLY THINK that Paulson's $700 billion (yeah, it's really larger than that…) bailout plan will do anything considering the size of the problem?

In conclusion, I think you can see that we've been living in a world that is standing on its head; a topsy turvy world turned upside down. The forces of gravity pull equally hard on all Earthly structures and economic structures are no different. In the domain of today's digitized wealth, it's become all too easy to forget that the basis for all monetary and financial systems is TRUST , not financial ingenuity and computer programming skill. As in any relationship, trust - once lost - is not easily regained .

For many decades, we have unwittingly entrusted our wealth to a financial system that, beneath the surface, was becoming increasingly unsound, untrustworthy, and recklessly managed. In many ways, our government and government “regulators” even sanctioned (or, at least turned a blind eye to) the deterioration and have been instrumental in covering up what was really happening behind the scenes. In other words, they were not “regulating” anything.

We are now witnessing precisely what happens when the greater masses determine in unison that “the system” can no longer be trusted and they all head for the exits at once. As history has shown, it may ultimately take generations to regain the confidence of the people or it may never happen. That can only be determined by future leaders and, as I see it from where I stand, it may be a while.

As I'll show in my next post, stocks may not even return to their nominal 2007 highs within the next 20 years and, if that were to be the case, those depending on stock portfolios, 401k's, and IRA's to provide for their retirement needs may be sorely disappointed.

Please check back often and be sure to tell a friend about my blog if you can. Help spread the word.